Paper Tax Refund Checks On The Finest Way Out As Irs Shifts To Electronic Funds

No one loves paying taxes, however taxes do present the money necessary to fund necessary authorities services and benefits (well, for essentially the most part). Tax revenues fund everything from Social Security benefits and military spending at the national level to constructing faculties and fixing that annoying pothole on the freeway (eventually) on the native degree. The Taxpayer Advocate Service is an impartial organization inside the IRS that helps taxpayers and protects taxpayers’ rights. If you qualify for our assistance, which is all the time free, we will do every thing attainable that will assist you. After you file electronically, you need to get an e-mail https://tax-tips.org/ confirming the IRS received and accepted your tax return. TurboTax Free Edition supports Form 1040 and limited tax credits solely.

The possibility was “initially provided in a dozen states last yr to low- and moderate-income taxpayers with easy returns,” a trial run that resulted in “most filers giving it high marks,” said The Model New York Occasions. Now that there are many different tax software program applications the competition is fierce. There are always tax software applications on particular offer, along with other incentives to get you to commit to a sure brand. Some have one-off prices while others work on a subscription basis.

Though the IRS usually points greater than 90% of federal tax refunds inside 21 days of accepting them, typically it can take longer than that to receive your money. Study the way to examine the status of your federal income tax return right here. The IRS estimates that tens of millions of taxpayers who qualify for the EITC do not declare the credit, lacking out on a benefit doubtlessly worth thousands Tax Filing Options of dollars. Using one of many free services will assist taxpayers save money in correctly calculating and paying their tax or receiving their refunds.

Taxpayers should proceed to use present payment options till further discover. Additional steering and information for submitting 2025 taxes might be issued prior to the 2026 submitting season. WASHINGTON — The Inner Revenue Service, working with the united states

- Whereas Jackson Hewitt On-line could be accessed from wherever with an web connection and throughout platforms, it’s not as well centered for mobile users because the competition.

- Generally, the income restrict to qualify free of charge tax assistance is $67,000.

- Statutes of limitations are the time periods established by regulation when the IRS can review, analyze and resolve your tax-related points.

- TaxAct has been round for lengthy sufficient now to know tips on how to help its users tackle tax submitting in no-nonsense trend.

- If you can’t file by the due date of your tax return, you need to request an extension of time to file.

According to Navy OneSource, the supplier of the tax software program, these tax providers are available to those who are service members (new, current or transitioning) and their spouses, survivors and reserves. Virtually all service branches are lined, including the Military, the Nationwide Guard, the Marine Corps, the Navy, the Air Force, and the House Drive. Most states have revenue taxes, too, and the way these work often is determined by the place you reside and your residency status. For instance, some states follow a progressive system, very like the federal authorities, whereas others tax income at a flat rate. Nine states, similar to Alaska and Wyoming, do not have a state income tax. This is when the agency started accepting and processing tax returns.

Jackson Hewitt Online is as much about having support from real people as it’s getting you from the beginning to the top of your tax return. Indeed, different limitations such as a taxable earnings underneath $100,000 will probably drive you towards the paid variations, but they’re all very helpful. The TaxSlayer interface is up there with the best of the competitors, but it’s leaner on the features front, similar to lacking more refined import of forms. TaxAct has announced new options for its latest version, with probably the most distinguished addition being TaxAct Xpert Assist. This is an add-on service, which supplies customers with limitless, on-demand, one-on-one support.

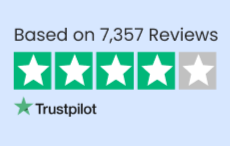

Regardless of the place you’re in the process, we have a six-step cheat sheet on tips on how to do your taxes and how to make tax filing easier. We consider everyone should be capable of make financial selections with confidence. We assess how properly the service integrates with other relevant apps, and check the overall scalability of the service. We also analyze whether there are collaboration options for a number of customers, and lastly, we judge the standard of the customer service and the totally different pricing plans obtainable. On the draw back, clients of Liberty Tax sometimes grumble about some aspects of its usability and less on-the-ball customer assist. Nonetheless, if you’re ready to take on those compromises then Liberty Tax is an different choice to contemplate, particularly if some face-to-face assistance is more likely to be required along the way.

A tariff is a tax imposed by a authorities on goods imported from another nation. Tariffs are paid by companies that import the goods, both as a percentage of the product’s worth (ad valorem tariff) or as a set charge per merchandise (specific tariff). The revenue created from tariffs goes to the government of the importing country. If you’re in the 24% tax bracket, for instance, not all your revenue might be taxed at 24%. Some might be taxed at 10%, some at 12% and 22%, and the final bit of your earnings will be taxed at 24%. If you’ve chosen to make use of Free File Software and are having bother with the program, contact the customer service unit for the software program firm.