Riga Wikipedia

We specialise in tax accounting for contractors, limited companies and the self-employed. We can guide you through each step of the process, from serving to you understand your tax obligations to ensuring you meet all authorized requirements with Corporations Home and HMRC. Being registered with Corporations House offers the LLP formal standing, making it extra interesting to potential purchasers and business partners. This might help you safe larger contracts and construct belief with stakeholders.

Such buildings were, amongst others, St. Peter’s Church which lost its wood tower after a fire caused by the Wehrmacht (renovated in 1954). Another instance is the House of the Blackheads, utterly destroyed, its ruins subsequently demolished; a facsimile was constructed in 1995. The Hansa was instrumental in giving Riga financial and political stability, thus providing the city with a strong foundation which endured the political conflagrations that had been to come back, down to fashionable instances. Begin your free trial with Shopify today—then use these assets to information you thru every step of the method. ❌ Startups seeking enterprise capital funding.❌ Companies needing simple possession switch.❌ Corporations on the lookout for better market credibility. ❌ Private Restricted Corporations are more trusted by buyers and customers.❌ Many massive organizations prefer dealing with firms over LLPs.

Like corporations, Restricted Liability Partnerships (LLPs) are also required to declare a registered workplace during incorporation. The registered office of a company is its principal place of work, serving as its official handle for all legal and government-related correspondence. It have to be a physical postal address located within the Registrar of Corporations (ROC) jurisdiction the place the company is registered. LLPs enjoy a number of tax benefits that make them an attractive choice from a taxation perspective. Unlike firms, LLPs are not subject to Dividend Distribution Tax (DDT) when distributing income to companions.

Key Takeaways

As a result of the battle of Jugla, the German military marched into Riga on 3 September 1917.49 On 3 March 1918, the Treaty of Brest-Litovsk was signed, giving the Baltic nations to Germany. As A Result Of of the armistice with Germany of Martinmas 1918, Germany had to surrender that treaty, as did Russia, leaving Latvia and the other Baltic States in a position https://www.business-accounting.net/ to assert independence. Latvia, with Riga as its capital metropolis, thus declared its independence on 18 November 1918.

Why Choose An Llp Over A Limited Company?

Enterprise capitalists and investors sometimes choose equity-based funding fashions, which aren’t available in the LLP structure. In Distinction To personal restricted corporations, which have a cap on the number of shareholders, an LLP allows for an unlimited number of companions. This flexibility is especially useful for businesses trying to scale or bring in multiple partners with various expertise.

Seamless Support From Day One

- This pass-through tax treatment is amongst the most beneficial advantages of forming a partnership.

- Andrew is a former content material strategist and small-business author for NerdWallet.

- These documents typically embody articles of organization or comparable formation paperwork.

- Choosing to run your organization as an LLC or LLP depends upon your profession and your state.

- (These names are examples and there is no connection to any firm registered with Companies House at present or in the future).

It is house to the European Union’s workplace of European Regulators for Electronic Communications (BEREC). LLPs are generally utilized by professionals corresponding to accountants, solicitors, and consultants who wish to work together whereas sustaining some independence and control of their own earnings. A company audit evaluates the financial well being of a business by inspecting its books, statements, and… Our experts will work with you to scale back your company, private or another tax legal responsibility, all within the rules of the UK tax legislations. We’ll ensure you’re claiming all allowances and expense claims that you would be elegible for. Keep up-to-date with the most recent news affecting small businesses, get enterprise ideas and tax saving recommendation.

Riga accepted the Reformation in 1522, ending the ability of the archbishops. In 1524, iconoclasts throughout iconoclast riots focused a statue of the Virgin Mary in the cathedral to make a statement towards spiritual icons. It was accused of being a witch, and given a trial by water in the Daugava river. Throughout the Russo-Swedish War (1656–1658), Riga withstood a siege by Russian forces. Establishing an LLLP requires careful planning and adherence to state requirements.

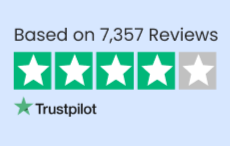

The platform was consumer friendly, making the complex strategy of business formation straight forward and accessible. The customer service staff was knowledgeable and responsive, promptly addressing all my inquiries. The efficiency and professionalism demonstrated by LegalZoom have provided me with confidence and peace of mind.I extremely suggest their providers to anyone seeking reliable enterprise formation help.

One Other main advantage is that you will not pay corporation tax in your profits. LLP profits are handled as your personal revenue, so you’ll only pay revenue tax on what you are taking out. In a basic partnership, all partners share unlimited legal responsibility, meaning their personal property are at risk if the enterprise incurs money owed. Basic partnerships are much less formal and don’t must be registered with Firms Home, however additionally they lack the legal responsibility protection that an LLP offers. Like anything in life and enterprise, there are advantages and drawbacks to restricted liability partnerships.

If a enterprise owner has a partner or partners, regularly, the obvious choice is to kind a partnership. You are responsible for reviewing and using this information appropriately. This content material doesn’t contain and isn’t meant to provide authorized, tax, or enterprise recommendation. Requirements are up to date regularly, and you should make certain to do your personal analysis and attain out to professional authorized, tax, and business advisers, as wanted.

The registered workplace reflectsa enterprise’s legal existences and performs a vital function in compliance beneath the Corporations Act, 2013. LLPs are often fashioned by skilled offices, corresponding to docs, accountants, or law places of work. Some states limit LLPs in order that they’ll only be arrange for particular professions, such as legal professionals and physicians. The partners in an LLP may have a variety of limited liability partnership disadvantages junior companions within the firm who work for them in the hopes of someday making full companion. These junior partners are paid a wage and often have no stake or liability within the partnership. The necessary level is that they are designated professionals who’re certified to do the work that the partners usher in.